If you’re interested to learn about capital allocation, The Outsiders by William Thondike is the seminal piece.

In the book, Thorndike evaluates the investment performance of eight companies and their leaders, unveiling their radically different approaches to generating above average, long-term returns.

The CEOs of these companies generated average returns that outperformed the S&P500 by a factor of 20x. Investment of $10k with each of these CEOs, on average would be worth $1.5M twenty-five years later.

These CEOs ran their companies with disciplined focus on valuation creation.

Commonalities include a decentralised organisational structure, inorganic growth via mergers and acquisitions and low or no dividend payouts.

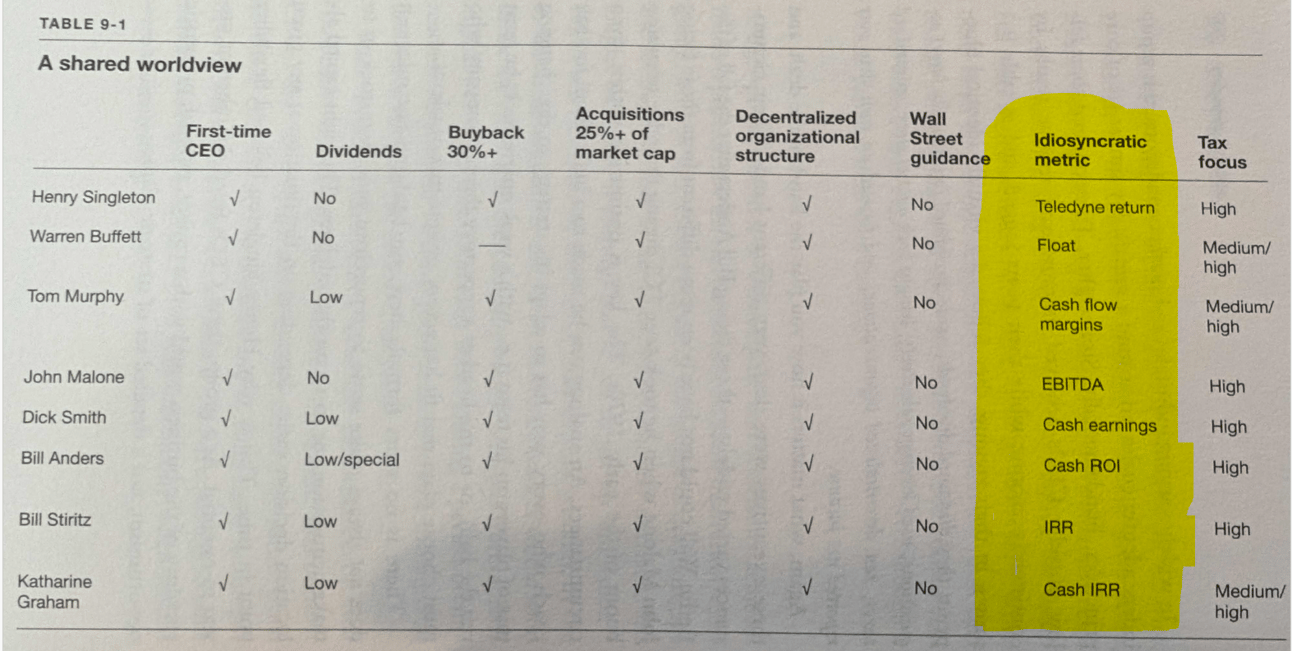

What was particularly interesting to me is that they all focused on a “north star” metric to guide capital allocation decisions.

The Outsiders by William Thorndike

Our North Star Metrics

Since starting the Arbor Group 8 years ago (my personal holding company), we have maintained a spreadsheet that tracks our north star metrics across our group of companies. They are:

ROIC

Free Cash Flow per share

Compounded book value

In this newsletter I’ll unpack the first metric, ROIC.

ROIC explained

A good business generates a high Return On Invested capital (ROIC).

Fundamentally, ROIC answers the question, “How much in returns is the company earning per dollar of invested capital?”

The basic ROIC equation is profits divided by invested capital, aka the capital needed for its operations.

NOPAT = Net profit after tax + interest expenses

Invested Capital = represents the capital required to grow the company and run the day-to-day operations.

NOPAT is pretty straightforward to calculate. You get your after tax net profit and add back interest costs (to compare apples with apples we want to ignore how the business was funded, be it debt or equity).

To derive Invested Capital, the operating approach is:

Invested Capital (IC) = Net Working Capital (NWC) + PP&E, net + Acquired Intangibles + Goodwill

ROIC example

Let’s compare 2 investment opportunities, an accounting firm and a grocery store business.

Accounting firm

Suppose I own an accounting firm that costs me $1,000,000 to buy. Services businesses like accounting firms are considered “capital light”, because they don’t have a great deal of hard assets like plant and equipment (machines) or receivables.

Suppose this accounting firm generates post tax-earnings of $300,000 a year.

This equates to a ROIC of 30%

That accounting firm is a pretty great business at a 30% return on capital. It takes $1M to buy and produces $300k in post-tax earnings. As long as you, the operator, have the skills to run and grow the business, it’s a business that we’d all probably enjoy owning. And over time, if the business can be scaled or buys other firms that produces similar returns, the owner of that accounting firm will likely become quite wealthy.

ASX listed Kelly Partners ($KPG) is an example of an accounting firm serial acquirer. That business is compounding ROIC at ~20% p.a - a pretty neat return on investment.

$KPG FY23 annual report

PS I wrote a financial teardown of $KPG if you’re keen to learn more about the economics of accounting firms.

Let’s compare this accounting firm to another investment opportunity that comes my way - my local corner grocery store.

Grocery store

This grocery store costs me $2M to buy, which mainly comprises of the store fitout, plant and equipment and inventory. This business generates post tax-earnings of $200k a year, equating to a ROIC of 10%.

So, which investment is better?

On face value the accounting firm is a much better investment at a 30% ROIC. And yes, as an owner of an accounting firm, I’m biased to say that.

But what if I was a killer grocery store operator? I have an edge in grocery store operations. What would it take for this opportunity to meet my investment hurdle?

Perhaps the current owners are unsophisticated when it comes to their operations. Limited inventory control and working capital management. In due diligence I see an opportunity to reduce and rationalise the number of SKUs. Cut low margin, slow moving SKUs, which both increases my gross margin and increases the velocity of stock turns from 7x to 13x per annum.

These activities result in increasing my profit from $200k to $350k, and halve the working capital requirements from $750k down to $375k.

Pulling these levers results in a ROIC of 25% - a fine investment.

I’ve basically turned my local corner store into a mini Costco. Furthermore, I can roll-out this playbook over multiple locations and continue to compound my capital at a 25% ROIC.

This is basically what Costco has done for over 40 years. The company’s ROIC has averaged 22% for over a decade!

Costco ROC

Accordingly, the share price has also done very well.

ROIC and valuation

High quality businesses tend to generate high ROIC.

The late Charlie Munger famously said that over the long-term a businesses returns will mirror its returns on capital.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns.

If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result. "

This is why it’s important to invest in businesses with defensible economics.

Ones that can grow it’s revenue and margins over a long period of time. In other words, businesses with some form of competitive advantage or moat.

Accounting firms and grocery stores aren’t sexy by any means, but you can comfortably bet that there will always be a business in tax compliance and milk runs.

Final thoughts on ROIC

The challenge for allocators is maintaining a high return on invested capital over a long period of time.

If there are opportunities to continue to reinvest in organic activities that generate a high ROIC, then it is rational for a manager to do so. An example is Costco rolling out more warehouses across the world.

The challenge is that all businesses will eventually hit a ceiling where it may simply run dry of organic re-investment opportunities.

Many smaller, family owned businesses simply lack sufficient organic reinvestment opportunities to substantially absorb and reinvest the cash flow they produce.

This has been a challenge for our accounting firm, SBO. We haven’t nailed a way to build a predictable growth engine in our business. We have a sales and marketing function, but allocating more resources to that function doesn’t translate to an immediate, nor predictable ROIC. It’s the nature of professional services business models - they are built on reputation, not Facebook Ads. The playbook to grow accounting, law firms and MSPs is via M&A.

This is why serial acquirors make great investment models. They can redeploy capital via acquisitions, which is what we do via our Holdco.

This is core to our capital allocation strategy at Arbor Permanent Owners. We will reinvest free cash flows into organic opportunities where there is a predictable path to meeting our ROIC hurdle rate of > 20%.

If we don’t have opportunities to reinvest, we allocate capital to inorganic opportunities that do.

About Arbor Permanent Owners

Arbor Permanent Owners is a Serial Acquirer holding company that acquires and invests in exceptional, private businesses, deliberately built for long-term success. Our goal is to be the long-term custodian and permanent home of Great Australian Small and Medium Enterprises (SMMEs).

We are actively looking for businesses with the following characteristics:

Business Model: B2B industrials: manufacturing and mission critical services

Business Size: $3 to $6 Million of EBITDA

Business Profile: Sticky B2B customer base

Business HQ: Australia

We are backed by a small group of co-investors, collectively on a mission to preserve the legacy of Great Australian SMMEs.

If you are a sophisticated investor and would like explore co-investment opportunities with us, please email us at [email protected]