Happy Friday Folks!

In last week’s newsletter I shared the North Star metrics we track for our personal holding company, Arbor Group.

Since starting 8 years ago, we’ve maintained a spreadsheet which tracks:

ROIC

Compounded book value

Free Cash flow per share

I covered ROIC in last week’s newsletter. You can catch up here in case you missed it.

This week I’m going to share how we calculate compounded book value.

At the bottom of this post you can download a copy of our valuation tool.

Thanks again for reading.

Please subscribe if you enjoy the content. We'd also appreciate you sharing it with your network.

Fund managers and investors will measure the Net Asset Value (“NAV”) of their fund to mark returns.

NAV is often close to or equal to the book value per share of a business.

It’s pretty simple to calculate:

NAV = (Assets - Liabilities) / Total number of outstanding shares

The result is a value per share.

If you invest in publicly traded shares, you don’t need to do this math, as you get a live daily share price.

However if you invest in private assets, there’s a bit more work involved.

Around 85% of my personal 'net worth' is tied up in private companies via my personal Holdco.

We own a combination of majority and minority interests in SMBs and technology companies.

Because these investments are not publicly traded, there's no "live" share price to measure the value of our portfolio.

This is unhelpful because as investors, we want to measure our performance.

So we built a tool scratch our own itch.

Since 2015 we've maintained a financial model in Googlesheets which tracks the entire value of our portfolio.

This is how it works:

We have a tab in the model for each investment.

Every month we upload the financials from our accounts (Xero) into the model, which spits out a valuation based on our predetermined assumptions (valuation multiples etc.)

For minority investments, like shares in a Startup, we mark these to market whenever there's a revaluation event (the company raises a new round of funding etc.)

We also carry cash on our group balance sheet, so that's added as well.

The output is a calculated $ NAV of our entire holding.

We also track how this value has compounded over time.

It's not a perfect tool, but it's helped us be accountable to one of our North Star Metrics: compounded book value.

It's also useful to view from a macro perspective.

When I'm having a bad day, or feeling unmotivated/deflated, this helps to remind myself how far we have come - and how far we have to go!

At Arbor Permanent Owners, an annual review of the portfolio will be carried out by a third-party valuer and will occur at 30 June of each financial year.

This is done to primarily to calculate and measure NAV so we and our co-investors can measure share price growth over time.

If we continue to meet our ROIC hurdle of > 20%, the compounded NAV growth will be the same, if not greater.

Some people have suggested that 20% is a relatively low hurdle for private market investing.

My feedback to them is that if you can maintain that for over 30 years (which is the goal), we’ll do a very fine job.

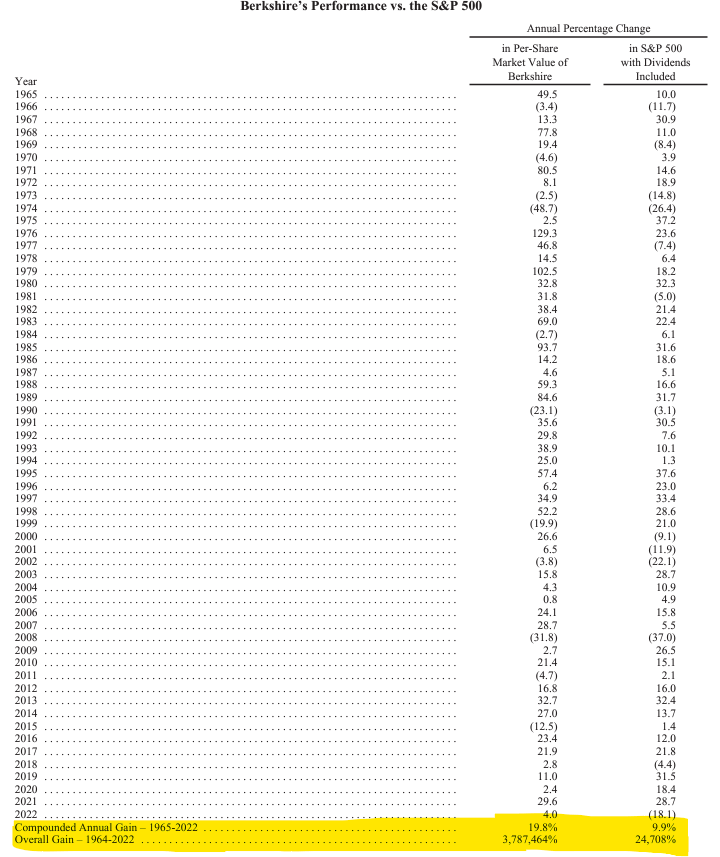

Berkshire Hathaway’s performance since 1965 - 19.8%

You can download a copy of our Holdco NAV tracker here.

About Arbor Permanent Owners

Arbor Permanent Owners is a Serial Acquirer holding company that acquires and invests in exceptional, private businesses, deliberately built for long-term success. Our goal is to be the long-term custodian and permanent home of Great Australian Small and Medium Enterprises (SMMEs).

We are actively looking for businesses with the following characteristics:

Business Model: B2B industrials: manufacturing and mission critical services

Business Size: $3 to $6 Million of EBITDA Business Profile: Sticky B2B customer base

Business HQ: Australia

We are backed by a small group of co-investors, collectively on a mission to preserve the legacy of Great Australian SMMEs.

If you are a sophisticated investor and would like explore co-investment opportunities with us, please email us at [email protected]